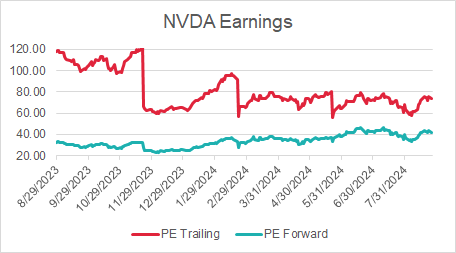

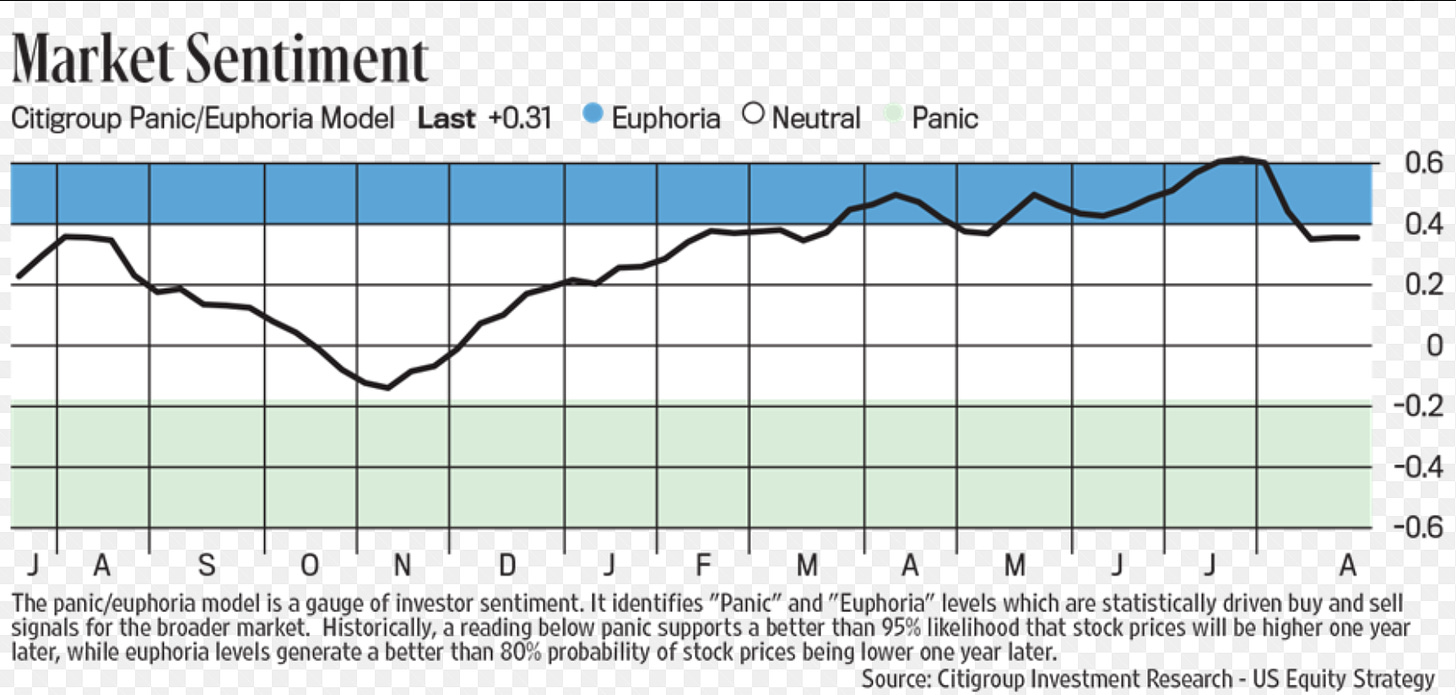

One of my favorite quotes is: good stock price does not mean good company, and vice versa. Last week, Jay Powell delivered what most people expected out of him, and this week through Labor Day week will be a test to the correlation between thin liquidity and volatility. NVDA earning on 8/28/2024 will be the core of such test. Looking at an atypical way to preview the earning, it is very telling that markets have been consistently under appreciating as PE forward (next 12 months) has been way underneath the PE trailing (last 12 months). The volume will largely be thin next few sessions, and any major event will shift sentiment quite quickly (if any). I am of a view that NVDA investors will stand to buy dips even from the beach.

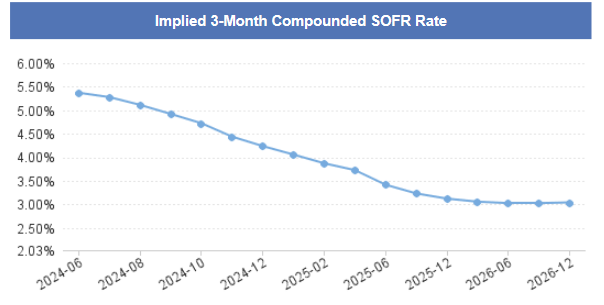

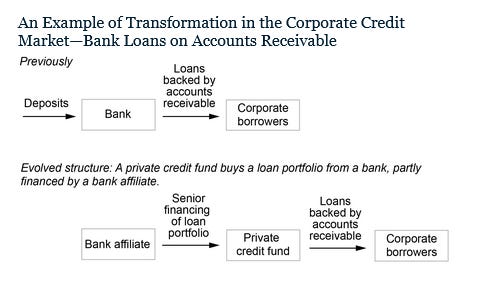

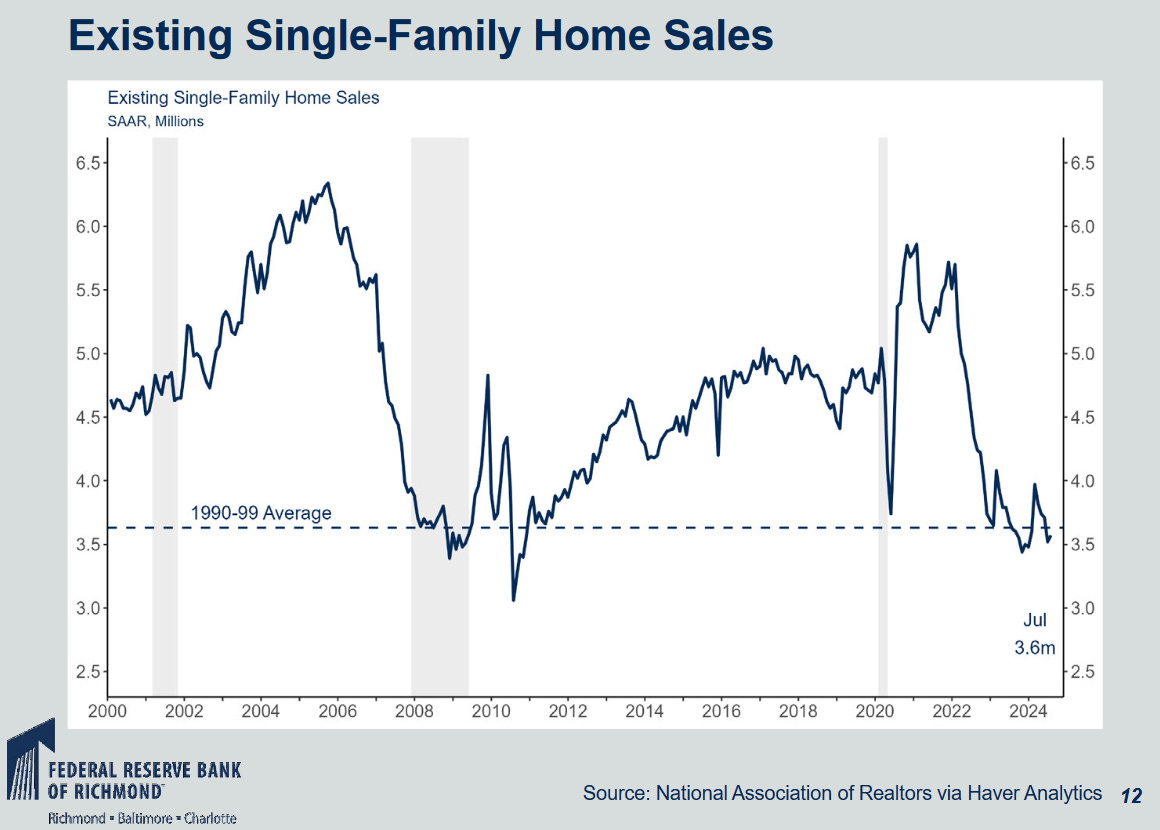

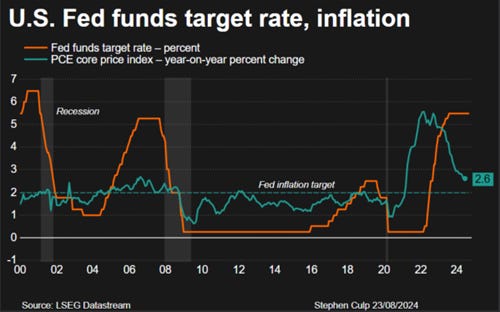

September 25bps or 50bps? Reading the tea leaves of Powell Jackson Hole speech, it was not very reassuring. The so called, “Powell Pivot” - looks more like a Powell Affirmation of current market pricing. Based on current pricing in the SOFR curve, it is almost assumed a recession in 2025, and I am not convinced that we will have such severe recession in 2025. Thus, front end of yield curve might be not be dropping much lower at such precipitous pace. All eyes on employment going forward, inflation is much less important.

Issuance: US sells $183bn in notes and $28bn in FRN with zero cash flow. Tuesday – US sell $69bn in 2Y; Wednesday – US sell $70bn in 5Y and $28bn in 2Y FRN; Thursday – US sells $44bn in 7Y.

The genesis of starting this blog and my value proposition is to share my approach to interpreting data and the tea leaves that others might overlook. I put in a lot of time and effort into writing this, and open to suggestion for enhancement. If you like this type of content, then consider subscribing and sharing to support my work. This means a lot and motivates me continue to post ideas.

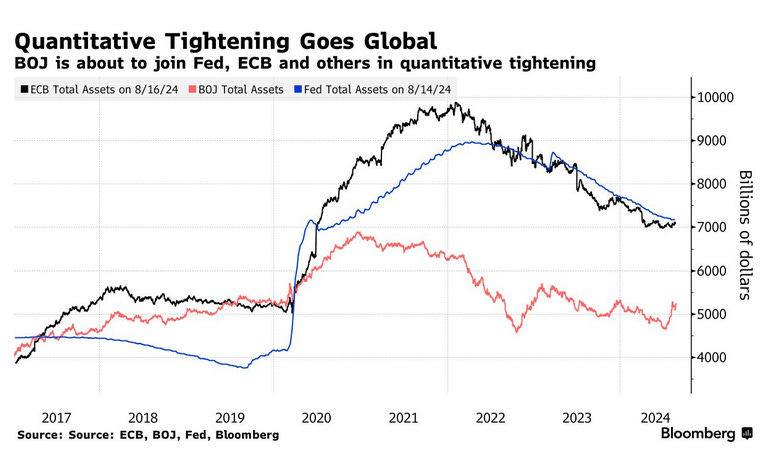

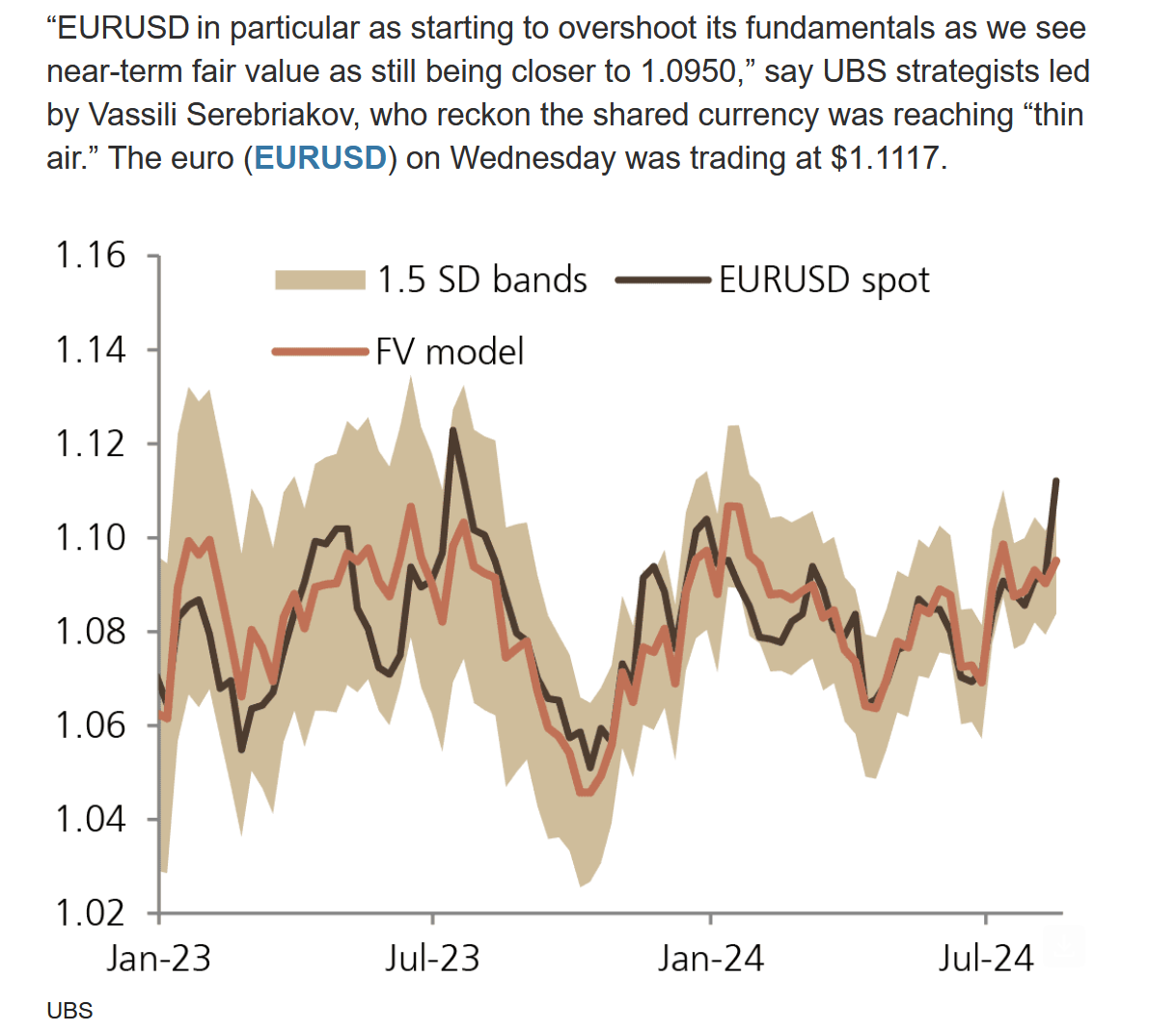

Charts I am monitoring:

Too good to be true?

Compared to Nvda, TSMC at the moment under appreciated especially after the Intel collapse. AMD, Google have competing products with Nvda but no one gets even close what TSMC can do at scale