The genesis of starting this blog and my value proposition is to share my approach to interpreting data and the tea leaves that others might overlook. I put in a lot of time and effort into writing this, and open to suggestion for enhancement. If you like this type of content, then consider subscribing and sharing to support my work. This means a lot and motivates me continue to post ideas.

9/23 morning notes

The market gives me the vibe of “I don’t care, wait until who gets into White House, what congress looks like, then I will see (or panic).” For now, music is on. Every blip proves to be an opportunity to rotate/buy. The market is still having a post FOMC drifting effect.

The week kicked off on China stimulus hope as PBoC cuts rate, fueling speculation of officials are ramping up effort to revive growth with a planed Tuesday press briefing. SPX future was up more than 20 pts in earlier Asian hours.

Then the Markets tanked on a cautious note as weak economic data spurred ECB rate cuts speculation. Euro Zone/ Germany /France September PMIs Flash were all under 50, entering technical recession territory. SPX slowly rebounded throughout US early morning session. As long as 5600 holds, gamma exposure is saying: BTFD.

The Week Ahead

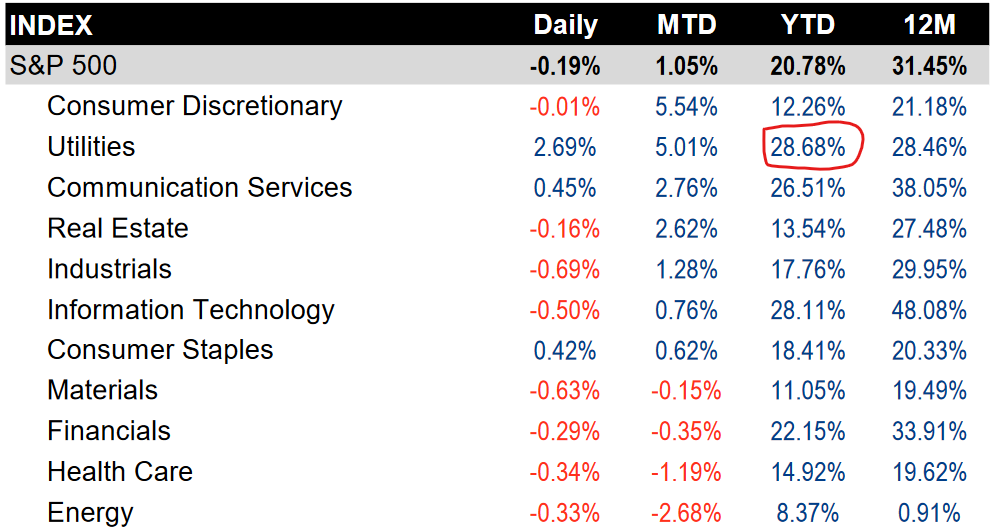

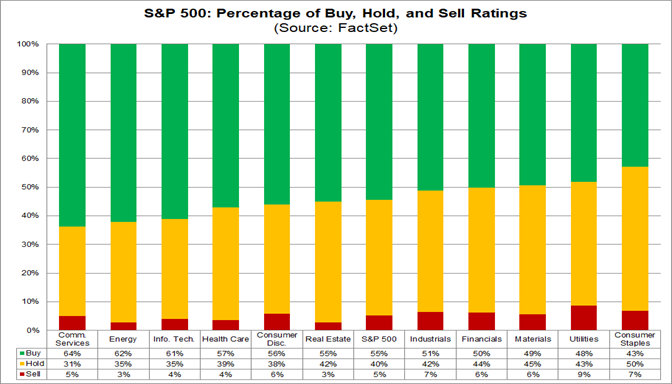

One must be surprised (or not) Utilities is best performing sector YTD?

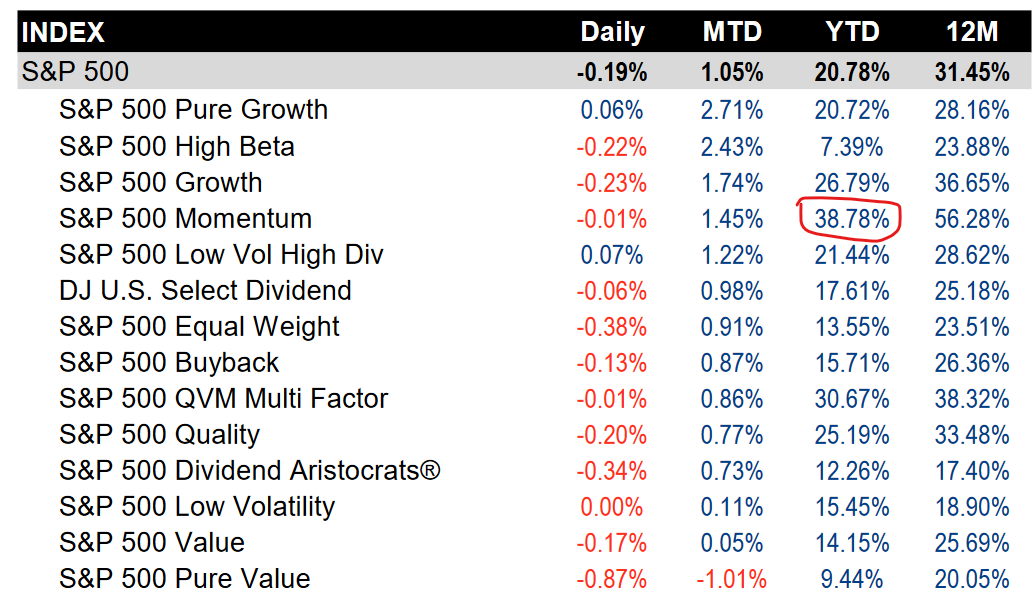

and as we go, follow the Momentum…

Summary

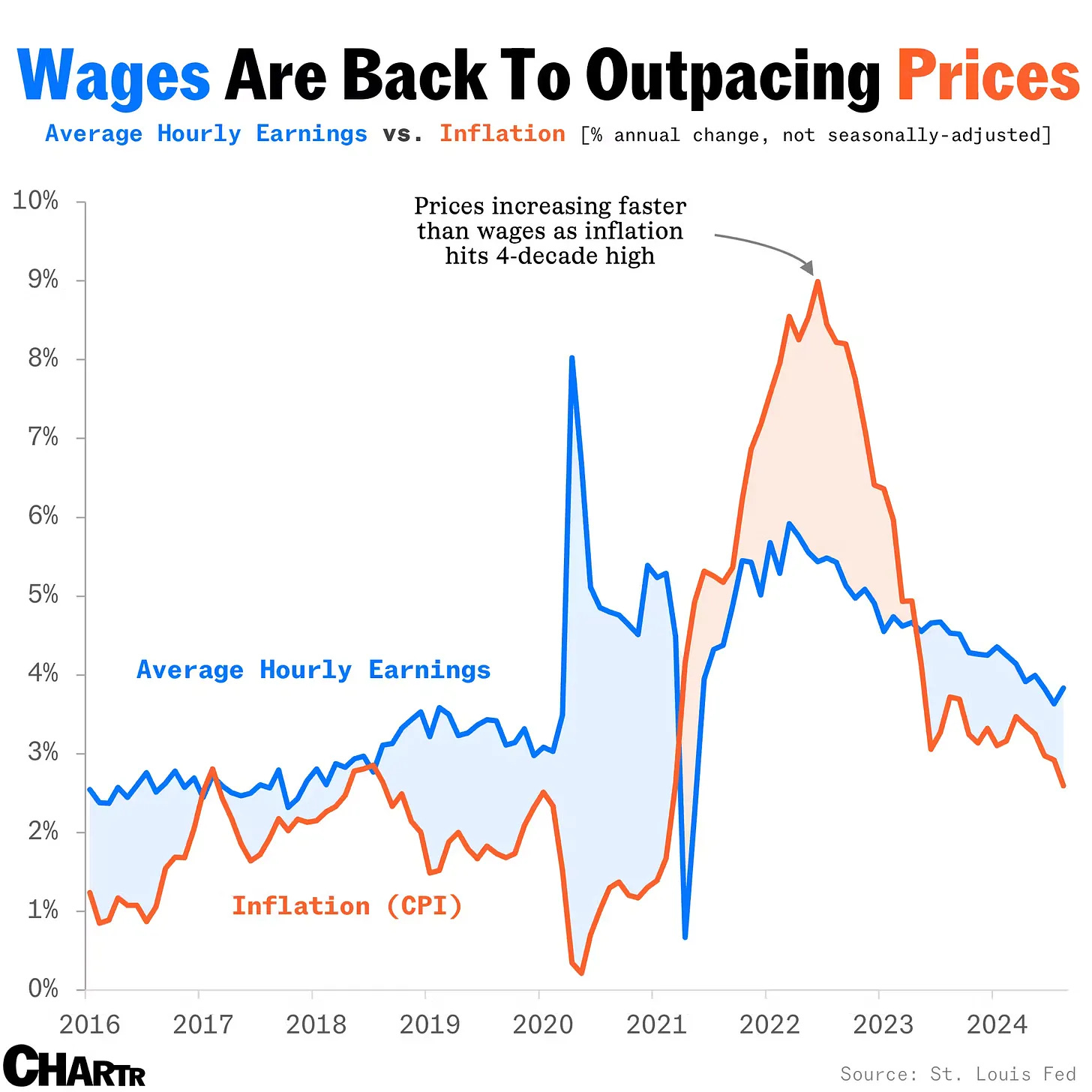

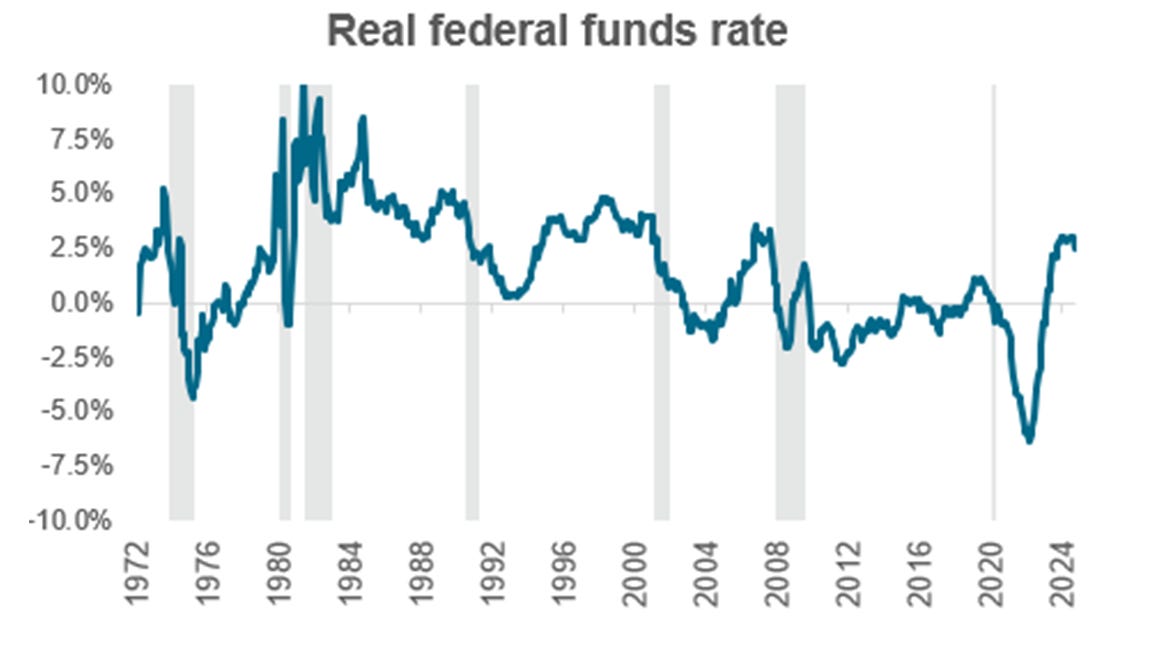

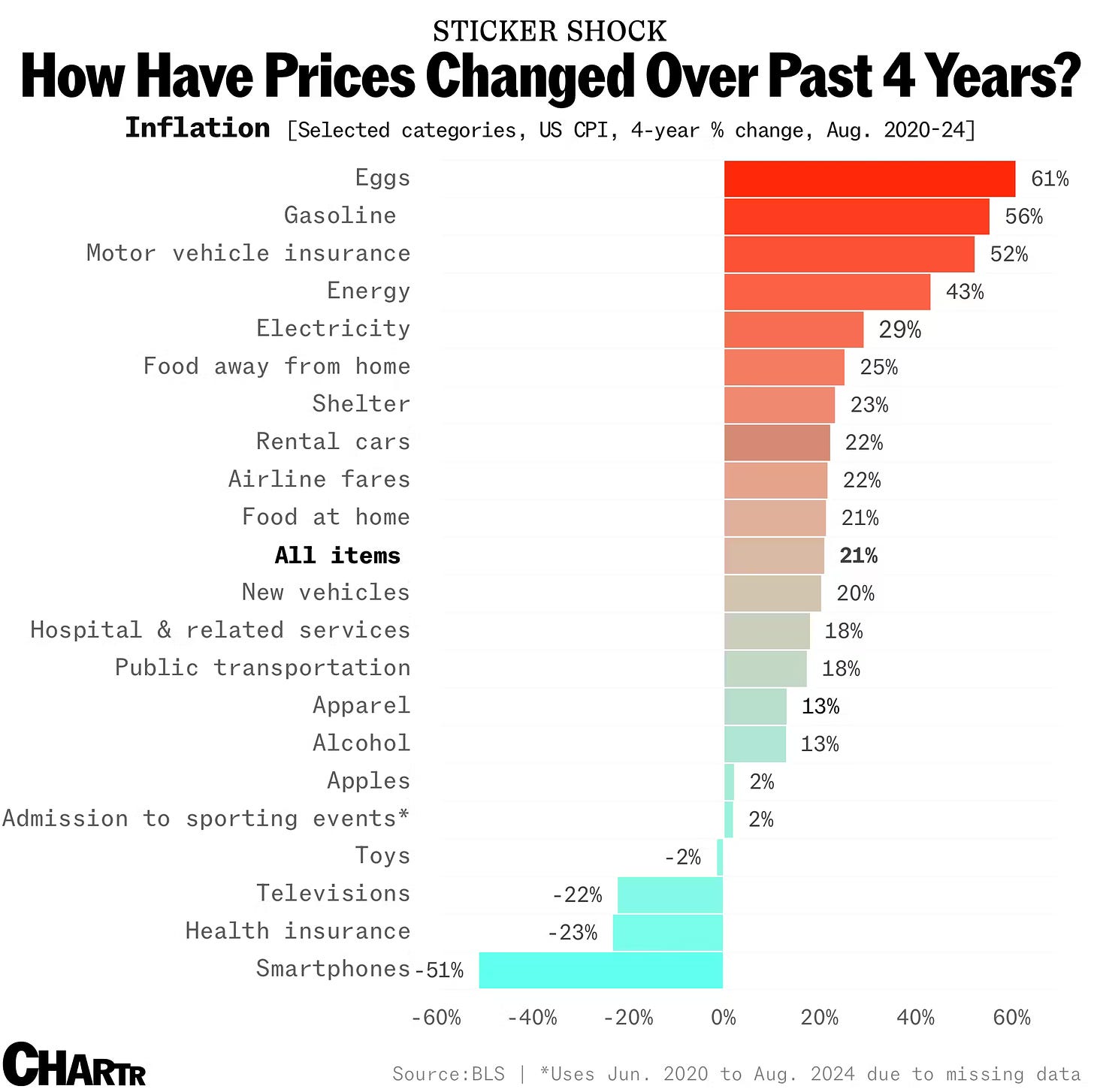

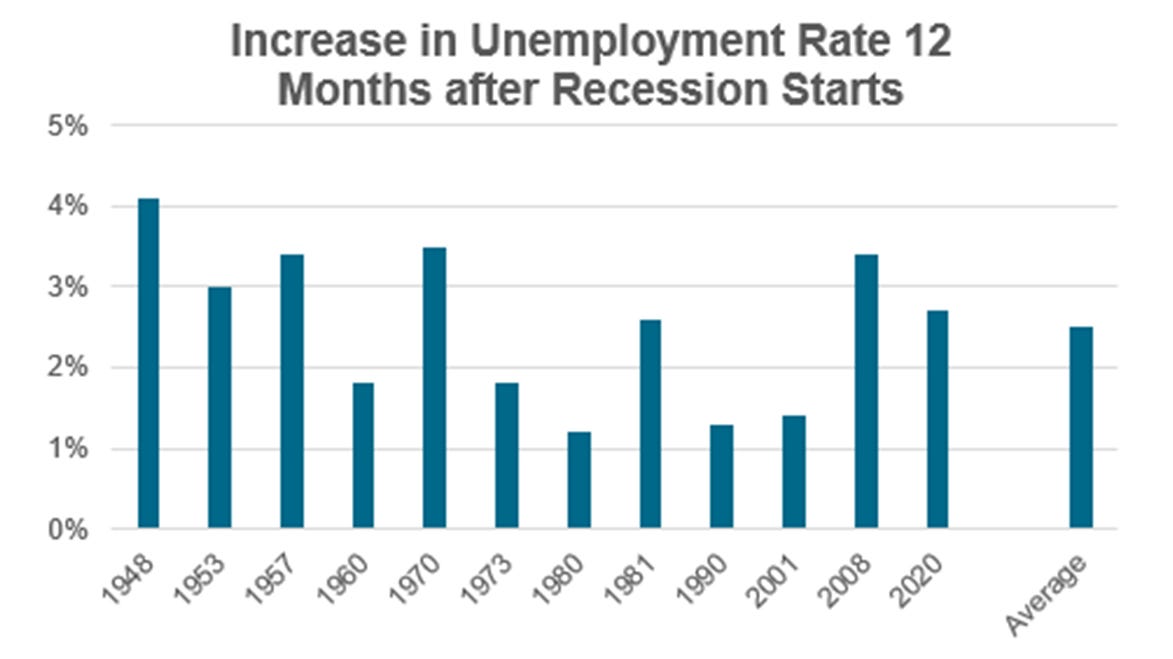

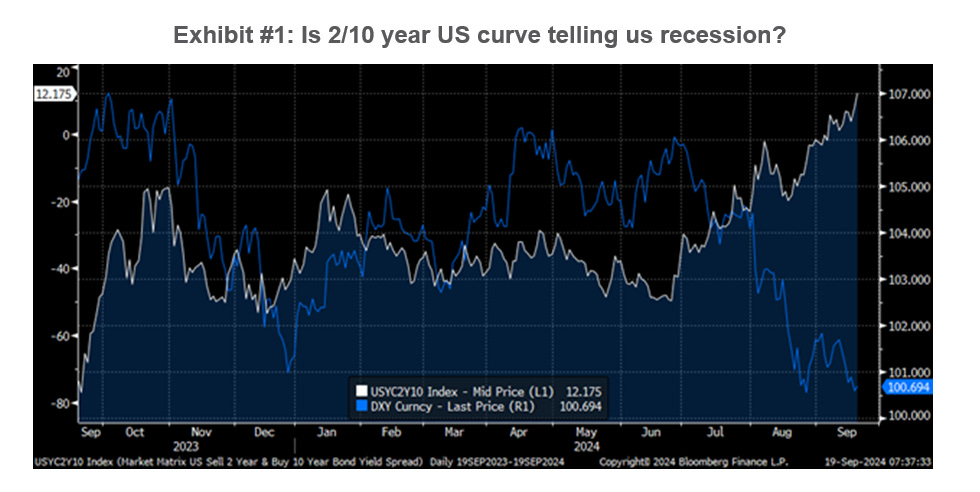

There are no major US economic releases this week but the week will be filled with Fed speakers and how they talk the narratives of 50bps cut. I view the 50bp jumbo move as risk management around the job market as I noted months earlier, “all eyes on employment going forward, inflation is much less important.” Obviously, official job number has been weakened, but wages are again back to outpacing prices. And as long as unemployment rate does not go above 4.5%, the economy would be fine albeit the Fed is running high risk of inflation rebounding if they continue to cut based on current market pricing.

What did Powell mean by recalibration? The fact that he came back to it time and time again. I tend to think he tried too hard to market the cut size and ignored the lagging effect of accelerated inflation on wages. Time will tell if he is right but as we progress next few weeks, I would like to pivot back to delta neutral and take what the markets give to us, i.e. take advantage of extreme moves and mean reversion at this high price level.

Economic Data and Treasury Auction:

Monday: US PMI, 3M and 6M bill; Bostic speaks 8AM, Goolsbee speaks 10:15am, and Kashkari Speaks 1PM.

Tuesday: $69 Billion 2Y Note Auction; Bowman Speaks 9AM.

Wednesday: New home sales; $70 Billion 5Y Note Auction; Kugler speaks 4PM.

Thursday: Jobless claims, PCE, GDP; $44 Billion 7Y Note; LOTS of Speakers!

Friday: Personal Income, Michigan Inflation Expectations; Bowman speaks 1PM.

Charts I am watching

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal.