The genesis of starting this blog and my value proposition is to share my approach to interpreting data and the tea leaves that others might overlook. I put in a lot of time and effort into writing this, and open to suggestion for enhancement. If you like this type of content, then consider subscribing and sharing to support my work. This means a lot and motivates me continue to post ideas.

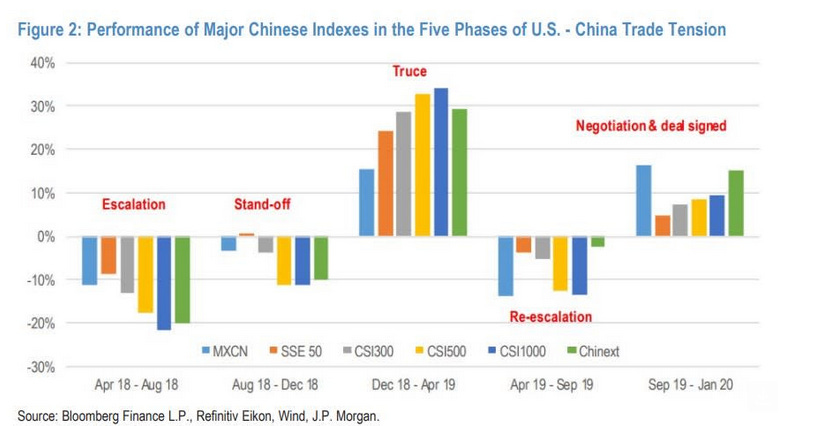

The U.S. economy will face a test this week with a series of labor market data to be released, as investors look for signs of a soft landing but the theme of the market in the near-term might be all about China.

China Trade

there is an interesting dynamics playing out in RMB FX market, markets have been too strong on CNH whilst most recent CNY fixing was nearly 300 pips lower than CNH’s current market pricing.

with Chinese national teams not selling into the rally like how they used to do, make me wonder A-share and H-share/ADR are going to diverge in performance next few sessions simply due to FX impact and assumed all else equal.

more specially so, Shanghai and onshore markets overall will likely outferform offshore HK/ADR market. Below was Monday’s

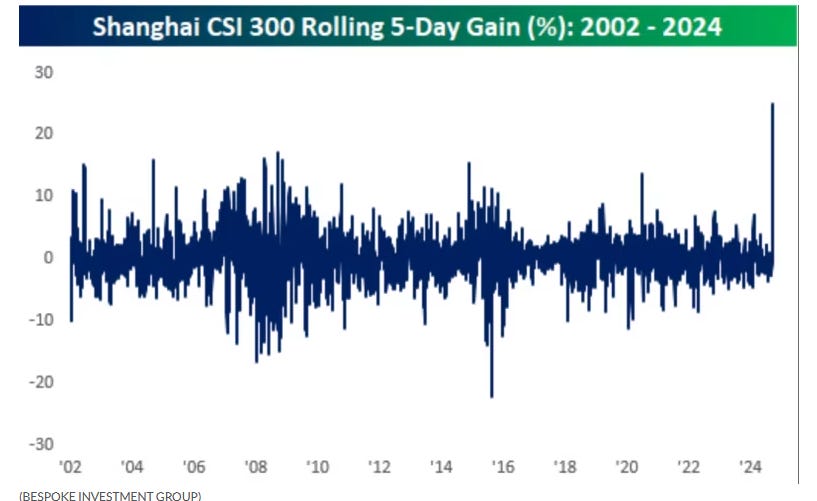

and as Monday price action shows, HK underperformed Shanghai. Regardless, last week’s CSI 300 performance was epic to say the least.

Oil Trade

I have been bearish on oil for awhile as Saudi’s cuts in past years did not bring back bulls. $10 price swings in oil has not been tradable to me, and if Saudi is resolute about taking back market shares. They will likely floord the market with LOTS of production and $50 is not a far reach. There is only reasons to be bullish then.

Economic releases:

Monday: Powell Speaks 1:55PM; $79 billion 3M bills and $72 Billion 6M bills.

Tuesday: ISM PMI, Jolts, GDP Now; VP Debate: Vance vs Waltz

Wednesday: OPEC Meeting 6AM, ADP Nonfarm;

Thursday: Jobless claims; SP Global PMI; ISM non-manufacutring PMI;

Friday: Payrolls reports, Unemployment rates;

Charts I am watching:

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal.