Summary

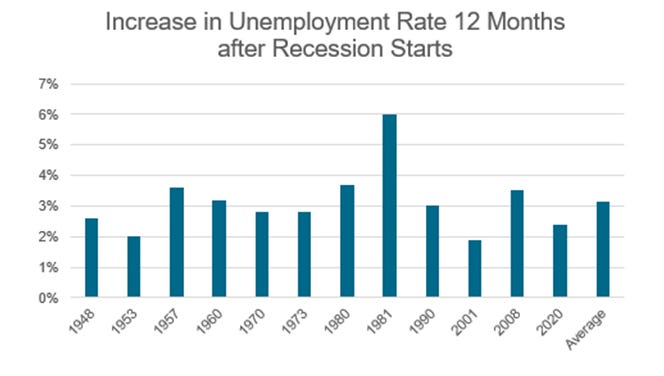

FOMC meeting - There has not been this coin toss moment before FOMC meetings in a while, but does 25 or 50 bps cut really matter? What investors should focus on is the path of rate cuts as the committee updates new Summary of Economic Projections and Jay Powell’s performance in press conference. The fear and signal of a recession has been conflicted by soft-landing hopes with equities, and bonds are pricing a worst case scenario. What goes up most comes down, and vice versa. CME Fed Watch shows a 57% of 50bps cut, and I believe 50 bps is the right move as I observed ZQ Nov24 closed at 95.37 (4.63%). If the Fed has to and will cut, why not get them in ASAP?

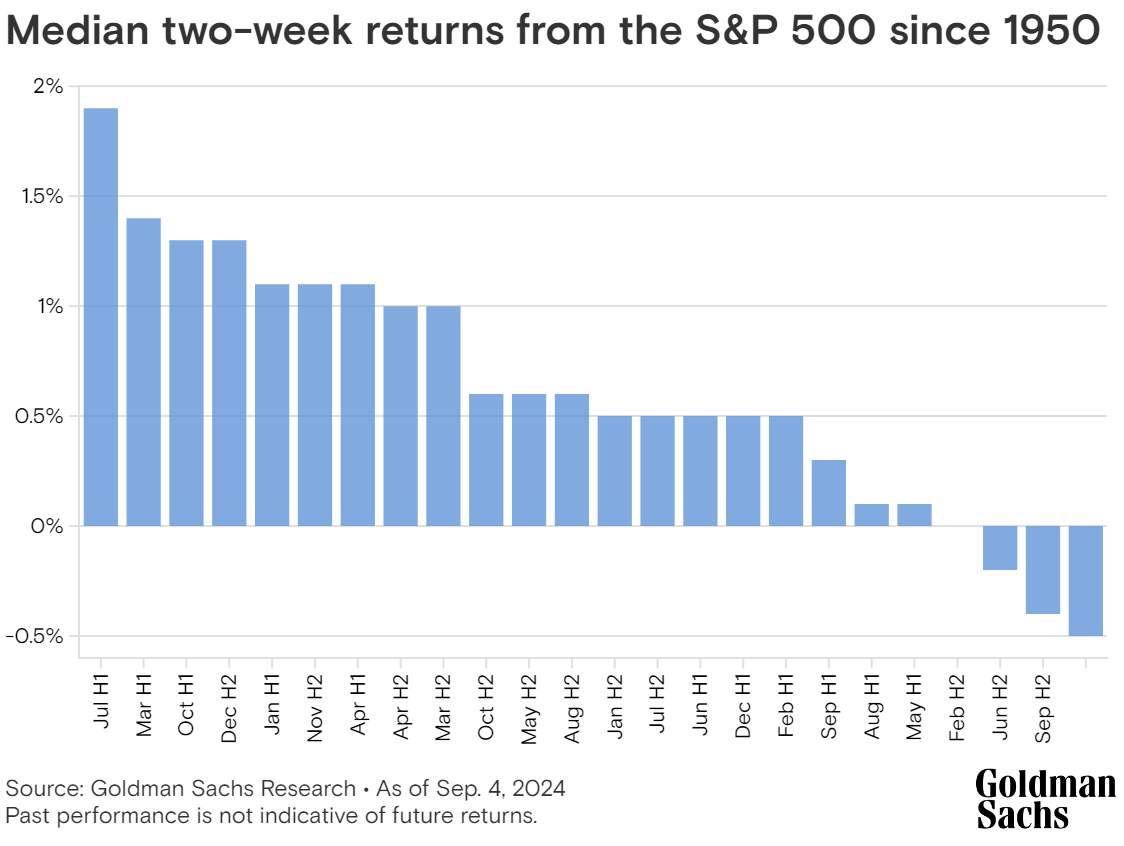

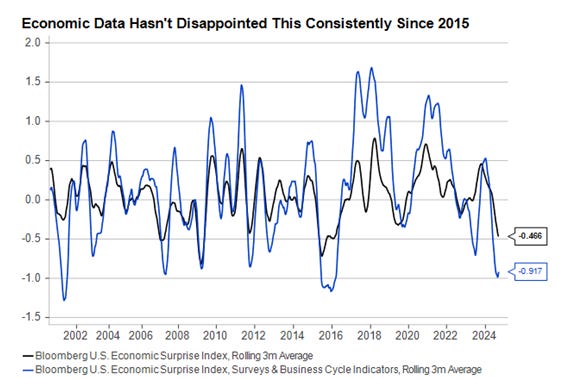

In grand scheme of things, the path is lower highs (if 2Y yield bounces) and 2H September is when the real “September Effect” kicks in as shown in chart below.

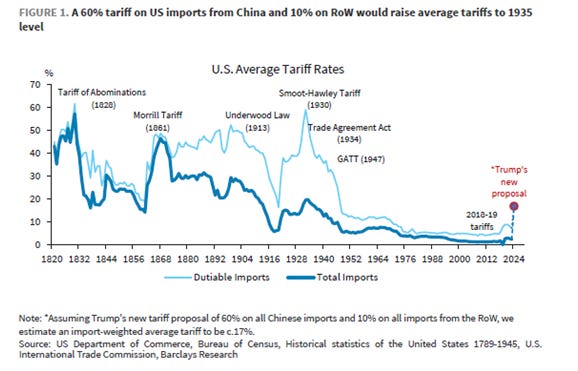

Presidential Race - As headlines dominated by the Fed this week, one cannot underscore the importance of second Trump assassination attempt and how that is going to boost Trump trade. The market decided that the debate last week went to Kamala Harris. As polls point to a Republican Senate and tied House b/w Democrats and Republican, only a Republican president will be able to deliver a large scale stimulus. US Dollar in close watch mode for this.

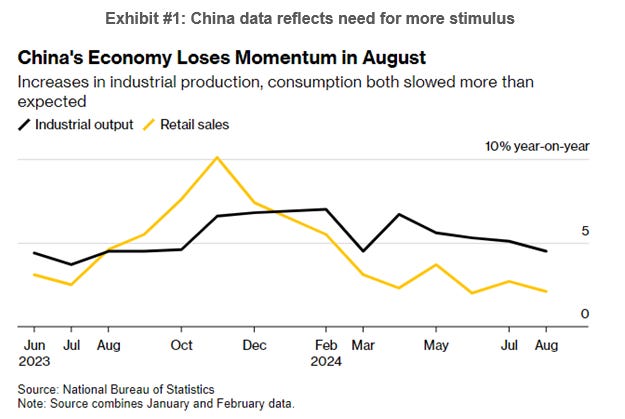

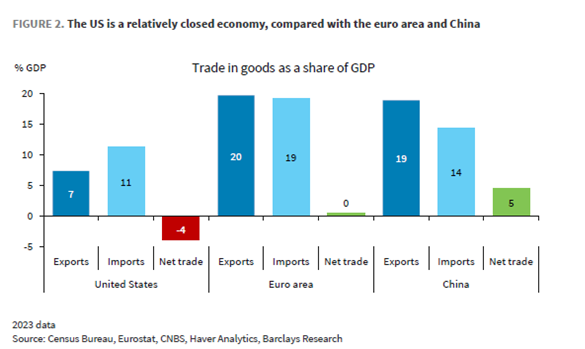

China Trade - getting exposure in Chinese equities has become a more interesting idea for me lately as waves of bad news piled in for China’s economy but resilient KWEB and HK market holding strong at the bottom. Both industrial output and retail sales have slowed more than expected. How bad can it get from here? China needs more stimulus, and once that is announced - shorts need to watch out.

Economic releases:

Tuesday: US retail sales and industial production; $13bn 20Y bond auction;

Wedneday: US housing starts, Crude Oil Inventories, FOMC meeting 2nd day;

Thursday: Jobless claims, US Leading Index; 4 and 8 weeks Bills.

Friday: Oil Rig Count.

The genesis of starting this blog and my value proposition is to share my approach to interpreting data and the tea leaves that others might overlook. I put in a lot of time and effort into writing this, and open to suggestion for enhancement. If you like this type of content, then consider subscribing and sharing to support my work. This means a lot and motivates me continue to post ideas.

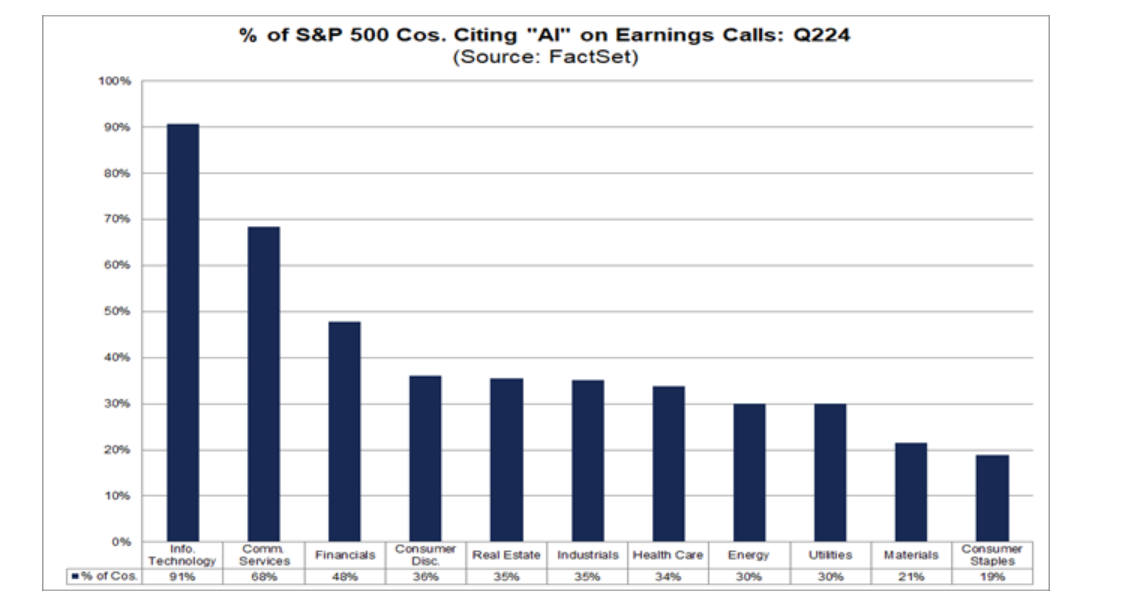

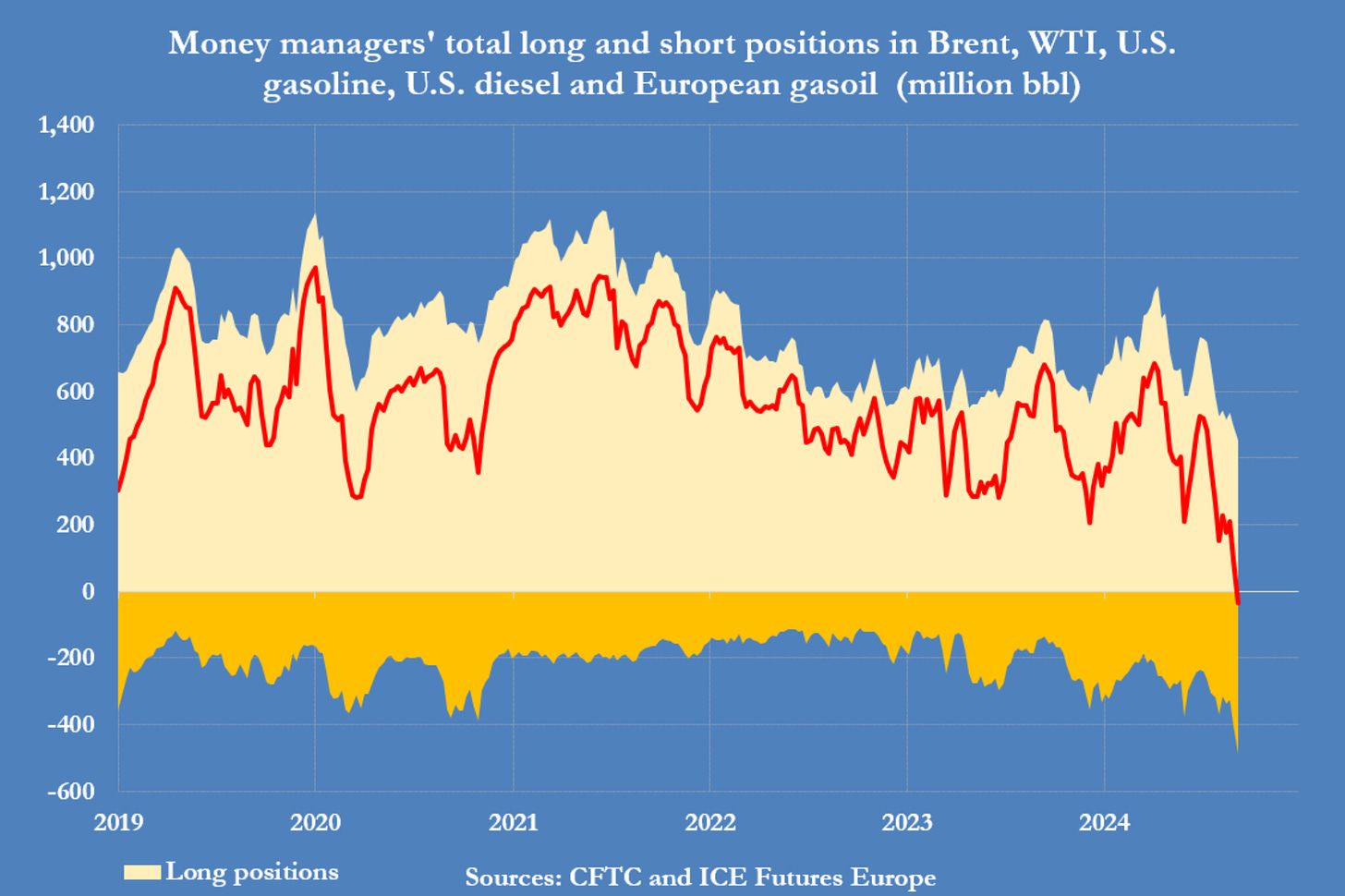

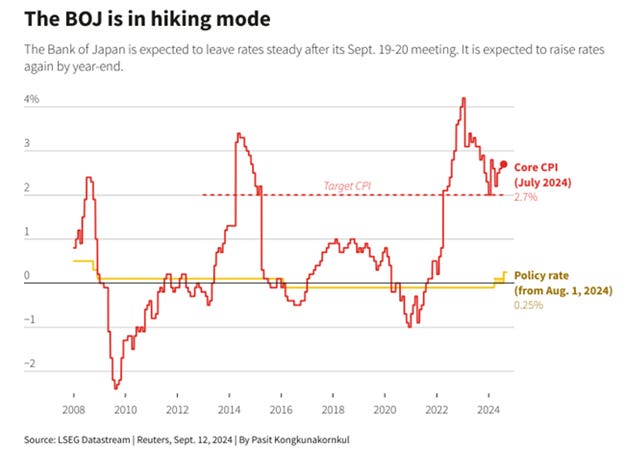

Charts I am monitoring:

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal.